When it comes to financial identification in India, the PAN (Permanent Account Number) stands as an essential element. Whether you’re filing taxes, opening a bank account, or conducting high-value transactions, the PAN plays a pivotal role in ensuring compliance and accountability. But have you ever wondered what the alphanumeric code on your PAN card represents? Let’s decode the PAN card number format and explore how Zwitch’s PAN Verification API simplifies the process for businesses.

Understanding the PAN Card Number Format

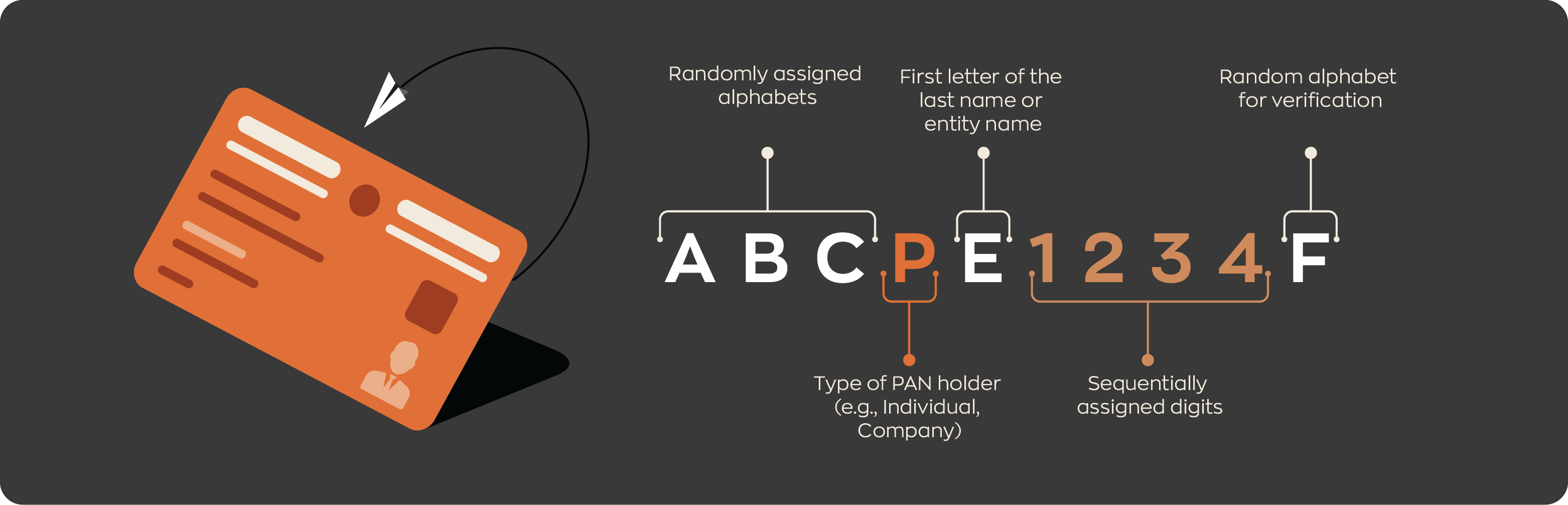

A PAN is a ten-character alphanumeric code issued by the Income Tax Department of India. Here’s how the format breaks down:

- First three characters: These are letters from AAA to ZZZ. They are a random sequence but are assigned systematically to prevent duplication.

- Fourth character: This signifies the category of the PAN holder:

- P: Individual

- C: Company

- H: HUF (Hindu Undivided Family)

- A: Association of Persons

- T: Trust

- F: Partnership Firm

- G: Government

- And so on, for other entities.

- Fifth character: Represents the first letter of the PAN holder’s surname or the name of the entity.

- Sixth to ninth characters: These are numerical digits from 0001 to 9999, assigned sequentially.

- Tenth character: This is a check digit, a randomly generated letter used for verification.

This structured format ensures that every PAN is unique, traceable, and aligned with the Income Tax Department’s database.

Why PAN Verification is Crucial

For businesses operating in sectors like fintech, banking, e-commerce, or payroll management, ensuring accurate PAN details is not just a regulatory requirement but also a trust-building measure. Here’s why PAN verification is indispensable:

- Compliance with tax laws: Incorrect or fraudulent PANs can lead to hefty penalties under the relevant acts.

- Fraud prevention: Verifying PAN details helps curb identity fraud and ensures that transactions are conducted with legitimate parties.

- Streamlined onboarding: Quick verification simplifies onboarding processes for businesses with multiple vendors, employees, or users.

Simplify PAN Verification with Zwitch’s PAN Verification API

Zwitch offers a low-code PAN Verification API that seamlessly integrates with your platform, enabling real-time validation of PAN details. Here’s how it adds value:

- Real-time verification: Instantly check if a PAN card number is valid and matches official records, ensuring quick and accurate identification.

- Secure & compliant: The API adheres to the latest data privacy and regulatory standards and ensures that sensitive user information is protected throughout the verification process.

- Scalable for businesses: Whether you’re verifying a single PAN or millions, Zwitch’s API handles the load with ease.

- Customizable integration: Designed for developers, the PAN Verification API is easy to implement into existing workflows with minimal coding required.

Example: A payroll company can integrate Zwitch’s PAN Verification API to validate employee PANs during onboarding, ensuring compliance while streamlining the onboarding and payout process.

Interested in our APIs? Let’s talk!

Tell us your automation goals, and we’ll set you up with a free, personalized demo from our API expert.

Click HereBest Practices for Using PAN Data

- Ensure data privacy: Always comply with data protection laws when collecting and storing PAN information.

- Verify in real time: Use APIs to minimize errors and avoid manual entry mismatches.

- Automate checks: Use tools to flag duplicates or invalid PANs for accuracy and efficiency.

- Educate users: Inform your customers or employees why PAN verification is necessary to build trust.

- Conduct periodic audits: Regularly review your systems and processes for handling PAN data to ensure compliance with evolving regulatory requirements and industry best practices.

- Limit access: Allow only authorized personnel to handle PAN data.

The PAN card number format is more than a random combination of letters and numbers—it’s a carefully designed structure that aids in identity validation and tax compliance. For businesses, ensuring accurate PAN verification is non-negotiable. Zwitch’s PAN Verification API takes the hassle out of this process, offering a seamless, secure, and scalable solution.

FAQs

What is the purpose of a PAN card?

A PAN card is used for tracking financial transactions, ensuring tax compliance, and serving as a unique identity proof for individuals and entities in India.

How is the PAN card number unique?

The alphanumeric format, combining letters, numbers, and a check digit, ensures that every PAN is distinct and traceable.

Why is PAN verification important for businesses?

PAN verification ensures compliance with tax regulations, prevents fraud, and streamlines processes like identify verification, onboarding and payouts.

How does Zwitch’s PAN Verification API work?

Zwitch’s API validates the PAN in real-time by matching it with official records, ensuring accuracy and compliance.

How can I integrate the PAN Verification API into my platform?

Zwitch’s API is developer-friendly and comes with low-code documentation, making it easy to integrate into existing workflows. Check the documentation here.

What is PAN 2.0?

PAN 2.0 is a modernized version of the Permanent Account Number system, integrating all PAN/TAN-related services into a unified digital platform, offering free e-PANs, paperless processes, enhanced security, and improved user convenience.

Sample PAN Card

0 Comments