India has experienced a dramatic shift in how people pay for goods and services, driven by the widespread adoption of the Unified Payments Interface (UPI). QR codes have become a common sight across the country, appearing everywhere from big city shops to small village markets, revolutionizing everyday transactions.

This digital payment revolution has touched virtually every corner of Indian commerce, transforming the way millions of people handle their daily financial transactions. In this blog, we’ll delve into what exactly a QR code is and how it has become such an integral part of India’s payment ecosystem.

What is a QR Code?

QR (Quick Response) codes are two-dimensional barcodes that can store vast amounts of information in a compact, machine-readable format. Originally developed by Masahiko Hara at Denso Wave in 1994 for tracking automotive parts, QR codes have evolved far beyond their industrial origins. In the context of UPI, these codes serve as a bridge between physical and digital payments, enabling instant fund transfers through a simple scan.

UPI QR codes are specialized variants designed specifically for India’s payment ecosystem. They contain encrypted information about the merchant’s UPI ID, business name, and other essential transaction details. Unlike traditional QR codes, UPI QR codes follow standardized protocols established by the National Payments Corporation of India (NPCI), ensuring universal compatibility across all UPI-enabled payment apps.

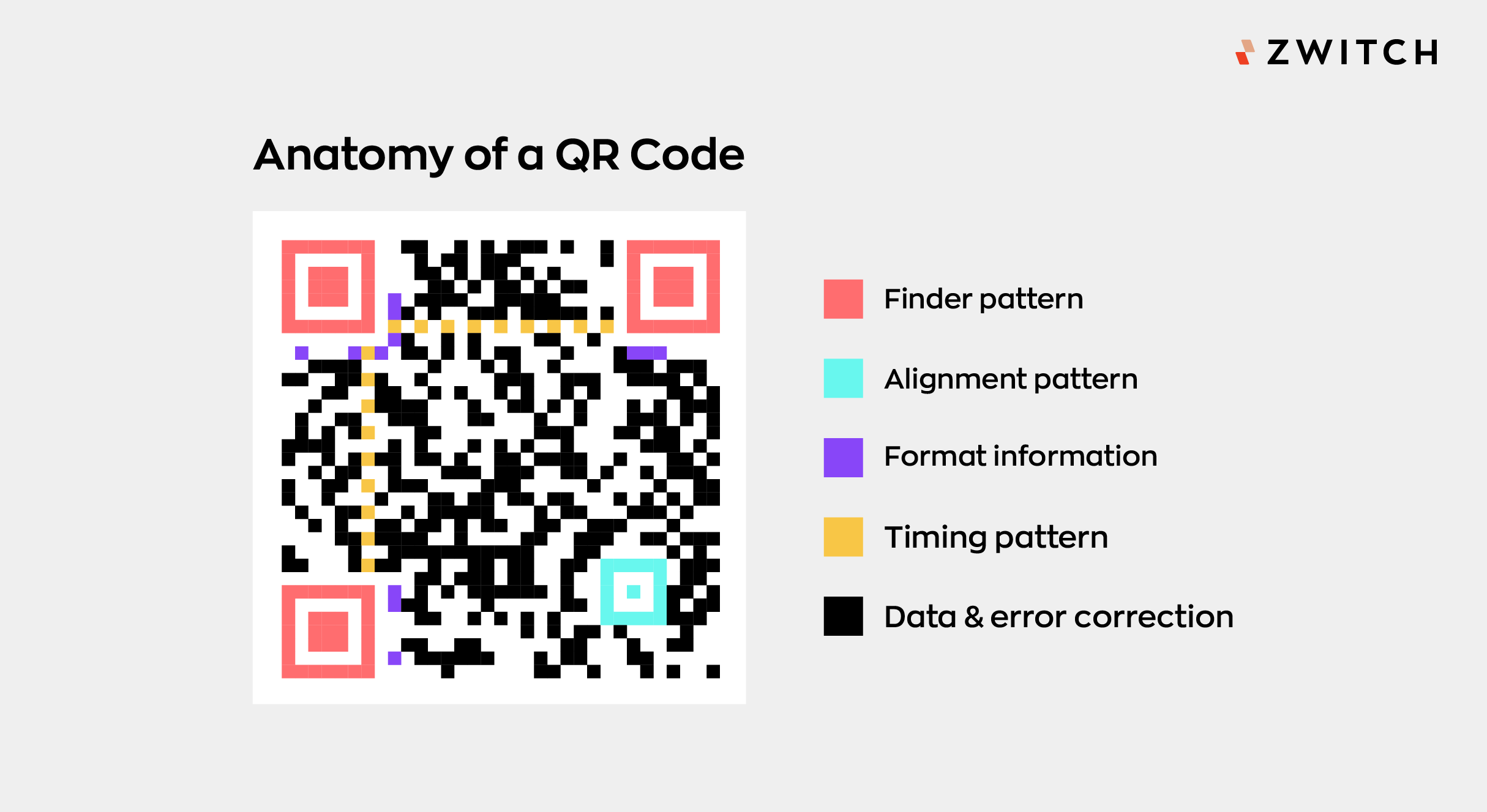

Anatomy/Structure of a QR Code

A UPI QR code consists of several distinct elements working in harmony:

The code itself is made up of black and white modules arranged in a square pattern. The key structural elements include:

- Finder Patterns: Three distinctive square markers located at three corners (top-left, top-right, and bottom-left) of the QR code. These patterns help scanning devices determine the code’s orientation and read it from any angle.

- Position Pattern: Additional patterns that work alongside the finder patterns to help establish the exact position and orientation of the code during scanning.

- Timing Pattern: Consists of alternating black and white modules running between the finder patterns. These help the scanner determine the individual cell size and position within the code matrix.

- Quiet Zone: A blank margin area surrounding the QR code on all sides. This border is crucial as it helps the scanner distinguish the QR code from its surroundings.

- Version Information: Data patterns that indicate the QR code version being used, which determines its data capacity and size. This information is typically encoded in specific areas near the finder patterns.

All these elements work together to ensure the QR code can be quickly and accurately read by scanning devices, regardless of orientation or minor distortions.

The data pattern contains crucial information, including:

- Merchant’s UPI ID or Virtual Payment Address (VPA)

- Payment amount (in dynamic QR codes)

- Additional transaction parameters

How Does it Work?

The UPI QR payment process involves several sophisticated steps happening in milliseconds:

1. When a customer scans the QR code using their UPI-enabled app, the smartphone’s camera captures the image and decodes the embedded information.

2. The app extracts the merchant’s UPI ID and other payment details from the code.

3. This information is transmitted to the UPI servers, which verify the merchant’s details and initiate the transaction request.

4. The customer then authenticates the payment using their UPI PIN.

5. The UPI system processes the transaction through its secure infrastructure, debiting the customer’s account and crediting the merchant’s account in real-time.

6. Both parties receive instant confirmation of the transaction through notifications.

Types of QR Codes

UPI QR codes come in several variants, each serving specific needs:

- Static QR codes: These are permanent codes that remain unchanged for each transaction. They only contain the merchant’s UPI ID and basic details. The customer needs to enter the payment amount manually.

- Dynamic QR codes: Generated for specific transactions, these codes include pre-filled amount information and expire after use or a set time period.

- Personal QR codes: Used by individuals for peer-to-peer transactions, these codes are linked to personal UPI IDs.

- Business QR codes: These contain additional merchant information and can be integrated with business accounting systems.

Benefits of QR Code

The QR code payment system offers significant advantages for both merchants and customers:

For merchants:

- Cost-efficient payment acceptance through the elimination of traditional POS (Point of sale) terminals while maintaining real-time transaction confirmation.

- Zero transaction fees for standard QR code implementation, making digital payment acceptance accessible to businesses of all sizes.

- Automated digital transaction records that streamline accounting processes and simplify tax compliance requirements.

- Reduced cash handling risks and associated operational costs.

For customers:

- Simplified payment process through mobile-only transactions, eliminating the need for physical payment instruments.

- Enhanced security through end-to-end encryption and mandatory PIN authentication for each transaction.

- Universal compatibility across all UPI-enabled applications, providing payment flexibility.

- Immediate transaction confirmation and digital receipt maintenance for better record-keeping.

Interested in our APIs? Let’s talk!

Tell us your automation goals, and we’ll set you up with a free, personalized demo from our API expert.

Click HereChallenges & Limitations

Despite its success, the QR code payment system faces several challenges:

Network connectivity remains a crucial requirement, and poor internet coverage in some areas can disrupt transactions. Some older smartphones may struggle with QR code scanning, particularly in low-light conditions.

Security concerns include the possibility of fraudulent QR codes and phishing attempts. Many users, especially in rural areas, need education about safe usage practices and common scams to avoid.

Technical issues like payment failures during high-traffic periods and occasional system downtimes can affect user confidence.

FAQs

What should I do if my QR code payment fails but money is deducted?

Don’t worry – failed transactions are automatically reversed within five working days in most cases. You can also check the transaction status in your UPI app or raise a complaint through the app’s customer service.

Is UPI ID & VPA the same?

Yes, UPI ID and VPA (Virtual Payment Address) are the same thing. Both terms refer to your unique payment address used for UPI transactions, typically in the format username@bankname.

Are UPI QR code payments secure?

A: Yes, UPI QR payments are highly secure due to multiple layers of encryption and PIN authentication. However, always scan QR codes from trusted sources and verify the merchant details before making payments.

Can I generate multiple QR codes for my business?

A: Yes, you can generate different QR codes for different locations or purposes. Many UPI apps also offer business-specific features for managing multiple QR codes.

Can I generate my own UPI QR codes?

Yes, you can generate a personal UPI QR code through:

- Your bank’s mobile app

- UPI-enabled payment apps

- Online banking platforms

For how long will be the UPI QR code active?

The UPI QR code remains active as long as the linked account is valid and not deactivated. However, dynamic QR codes generated for specific transactions may have an expiration time set by the issuer.

0 Comments