In the finance world, everything’s gone digital. As more economic activity happens online, the need for internet businesses to establish and maintain high levels of trust increases commensurately. Well, if you’re still depending on trying to verify customers’ identity manually, then you’re definitely falling behind.

Businesses nowadays frequently need to verify the identities of their users and vendors to comply with “Know Your Customer” (KYC) norms — and increase trust and safety by reducing fraud, preventing account takeovers, and stopping bad actors.

KYC is part of the wider regulatory requirements for Customer Due Diligence (CDD) checks under Anti-Money-Laundering (AML) legislation. These checks are becoming increasingly complex and complicated for companies to manage. Many businesses report that their senior management and staff are spending more time bogged down in regulatory requirements.

These complex processes will have a detrimental effect on the customer onboarding process, causing delays and an increase in in-depth information requests.

Challenges in managing multiple data sets

In an increasingly global economy, KYC client onboarding is more complex than ever. Organisations need to access an ever-increasing range of data from multiple suppliers to ensure that firms can validate clients’ identities from different jurisdictions.

However, inputting client data into multiple data sources is inefficient and time-consuming and gives way to human error. Also, hours and hours of manual work would go into each stage, and a client could be off-boarded for any number of risk reasons. The work is mandatory, and the labour costs will hit your bottom line, thereby reducing your returns on investment.

If you’re losing your customer at multiple stages due to the time-consuming KYC process, then why not try an automated API driven KYC solution?

With far less need for manual work involved, Zwitch KYC APIs will automate checks to enable your business to stay compliant while benefiting from the increased efficiencies and reduced risk such solutions offer.

But before we discuss how Zwitch APIs can help you automate your KYC process, let’s look at different areas where KYC is mandated.

When is KYC Verification Required?

Here are some of the instances where Know Your Customer becomes mandatory to transact:

- When you opening a new bank account,

- While making fixed or recurring deposits,

- For periodic renewal of KYC, as directed by RBI,

- When there’s a change in the UBOs (Ultimate Beneficial Owners) of a company, or

- When company policy requires customers full disclosure

So yes, your business will need to upgrade to a smooth onboarding process if you’re thinking to be compliant!

What are the essentials required for KYC?

Once an individual declares their identity, the same has to be verified with reliable documents. When you go about with your KYC verification process, here are some of the documents that you will require.

We have broadly classified them as (i) Proof of Identity and (ii) Address Proof.

Identity Proof Documents

The documents required for Proof of Identity would mostly consist of any legal identification document issued by the central or state government, which has the individual’s photo. Some of them include PAN card, UID(Unique Identification Number which includes your Passport, Aadhaar card, driving license, or voter’s ID), ID cards issued by affiliated educational institutions, etc.

Documents for Address Proof

The documents required for Proof of address include an Aadhaar Card, Passport, Voters ID card, Lease agreement of the residence or registration document, Copy of the insurance made for residence, Maintenance or utility bills such as telephone(landline), electricity, gas, etc. Do keep in mind that these bills can’t be more than three months old, and also, the bank statements and passbooks aren’t more than 3 months old.

In addition, you can also make use of proof of residence documents issued by the Government or authority, Multinational Foreign Banks, Scheduled Co-Operative Bank, Gazetted Officer, Notary public, Parliament, or elected members of the Legislative Assembly.

How does an API Solution Help Your Company Manage KYC?

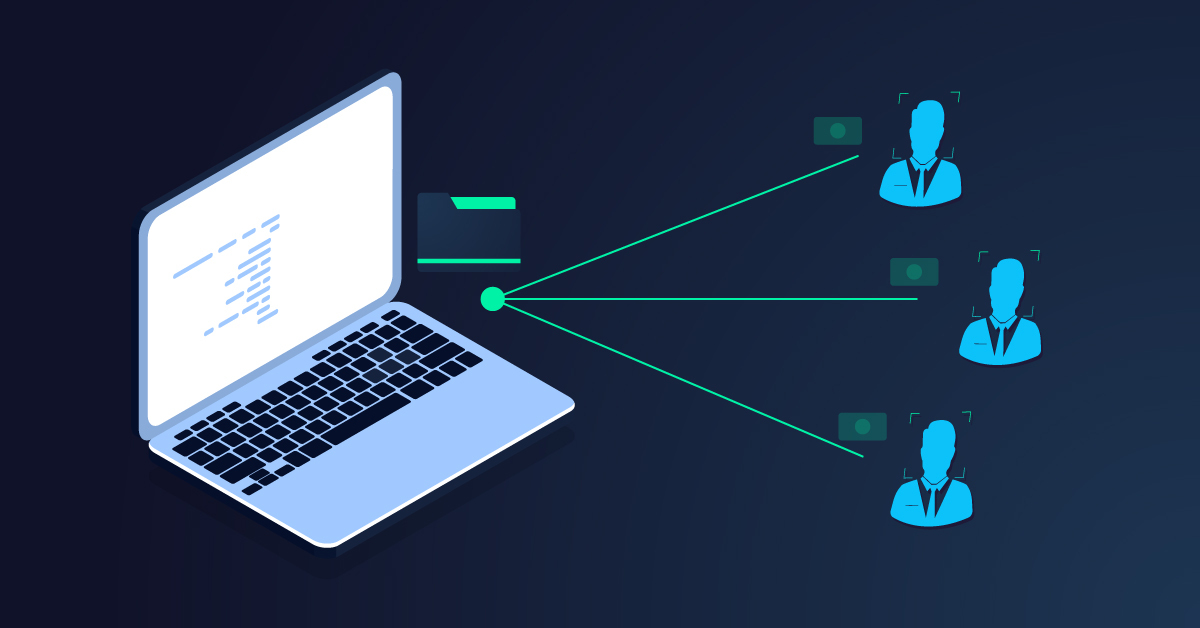

Automated KYC checks are part of the single API solution. They work by using a single point of entry to multiple data sets, allowing you to input your customer data once and thoroughly vet client information in your records without significant manual work.

The alternative is for you, or a member of your staff, to conduct regular, manual KYC checks. These are labour-intensive and introduce additional risk due to the increased likelihood of human error, which can threaten your company’s compliance.

You need to vet everything, from client contact details and credit history to financial dealings for every client on your books. It’s pretty easy to see why an automated KYC solution is the preferred option.

By selecting a single API-led automatic solution, you are opting for a reliable, secure and safe way to adhere to KYC regulations while also staying on top of any changes.

There are numerous reasons to use APIs when considering your KYC workflows:

- It is a cost-effective solution

- Speeds implementation time as they can connect to existing infrastructure

- Integrates seamlessly with other applications

- Reduces the rate of clerical errors

- Improves staff morale by lessening the drudgery of manual paperwork

- Delivers better reporting and information flow

- Eases the burden of record-keeping, as the process is digitized from the beginning

- Systemizes procedures across units, divisions and operating companies

- Enables quicker entry into new markets

- Provides a smoother customer onboarding experience

Zwitch your way for KYC solutions!

Zwitch API provides you with a programmable and straightforward way to verify identities online. A low-code integration option allows businesses to start verifying identities in minutes, with a verification flow fully hosted by Zwitch.

The information collected is encrypted and sent directly to Zwitch servers, so an individual business doesn’t have to worry about managing sensitive, personal information on its own servers. This means businesses can now verify identities more quickly, more easily, and more securely—but take on less effort and risk themselves.

To prove their identity, users take a photo of their government ID, which Zwitch advanced machine learning then matches the ID. Businesses can also request that users key in additional information to be checked against third-party records.

There are multiple benefits of using a Zwitch API solution. To ensure you don’t risk non-compliance, provide the following:

- Automated Updates: Consistent updates are given to ensure your business can manage KYC checks that are meeting all regulatory requirements

- Ease of Use: Simple and intuitive to use when conducting thorough KYC checks. You can request it with the touch of a button within your product.

- Fast, Safe and Secure: Share up-to-date, relevant data, zwitch team has integrated with firms that work with leading data suppliers and law enforcement agencies, and ensure the data the API accesses remain highly secure and protected.

- Streamlined Onboarding: The onboarding process shouldn’t be complex. Zwitch API solution streamlines the way of managing your data and conducting KYC checks efficiently.

When identifying the right solution for your business, look for a comprehensive and secure data set that is regularly updated. This ensures that the complex onboarding and monitoring of customers is accurate and in line with regulatory requirements. In that way, you are protected from the risk of penalties and fines due to missed compliance procedures. At Zwitch, we’ve left no stone unturned to ensure that businesses develop their best products using our APIs for their customers.