Digital payments in India have undergone a massive transformation, with UPI (Unified Payments Interface) leading the charge. But as transactions become faster, there’s still one pain point left unsolved: group payments. Enter UPI Circle – a revolutionary way to split bills, collect money, and manage shared expenses seamlessly within your trusted networks.

What is UPI Circle?

UPI Circle is a groundbreaking feature developed by NPCI that enables users to create payment circles for different groups. It’s designed to simplify the management of shared expenses by allowing a primary user to authorize trusted individuals to make payments from their UPI-linked bank account. This feature brings a new dimension to digital payments, making group financial management more streamlined than ever before.

Think of it as a WhatsApp group for money – but with built-in tracking, reminders, and auto-settlement.

Developed by NPCI as an extension of the UPI (Unified Payments Interface) platform, this functionality brings newfound convenience to tracking and settling shared expenses.

How Does UPI Circle Work?

At its core, UPI Circle operates on a delegation model. The primary account holder (you) can authorize secondary users to initiate transactions from your account, within specific limits and guidelines that you control. This creates a financial circle of trust where:

- You maintain control as the primary user

- Secondary users can make payments without having direct access to your bank account

- All transactions are transparent and trackable

- Limits can be set for different users based on your preference

This system preserves security while offering convenience for families, businesses, and friend groups who regularly share expenses.

How to Set Up UPI Circle

Setting up UPI Circle through the BHIM app is a straightforward process:

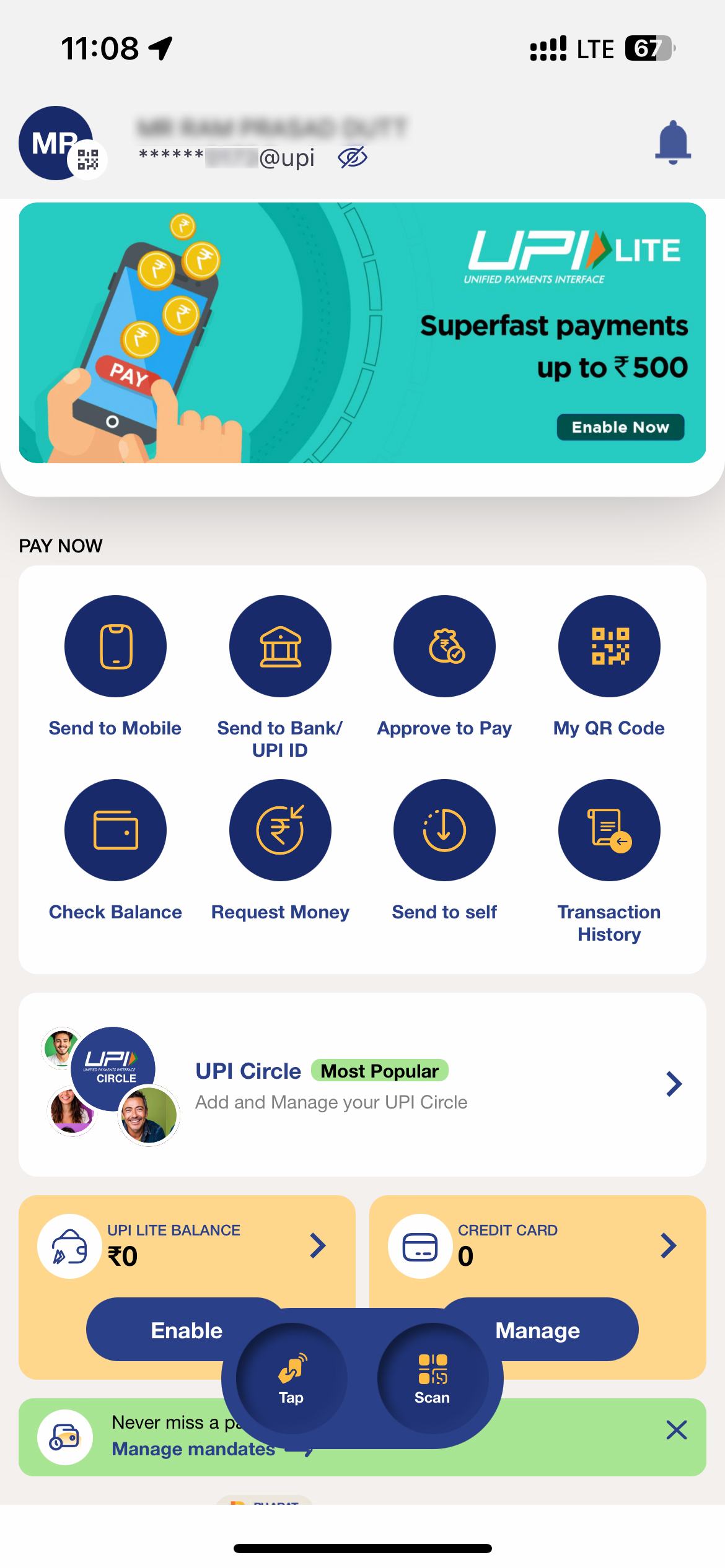

Step 1: Access UPI Circle

Open your BHIM UPI app and navigate to the UPI Circle option typically located in the main menu.

Step 2: Create Your Circle

Tap on Create New Circle and provide a name that clearly identifies the purpose of this group, such as “Family,” “Roommates,” or “Trip to Kashmir.”

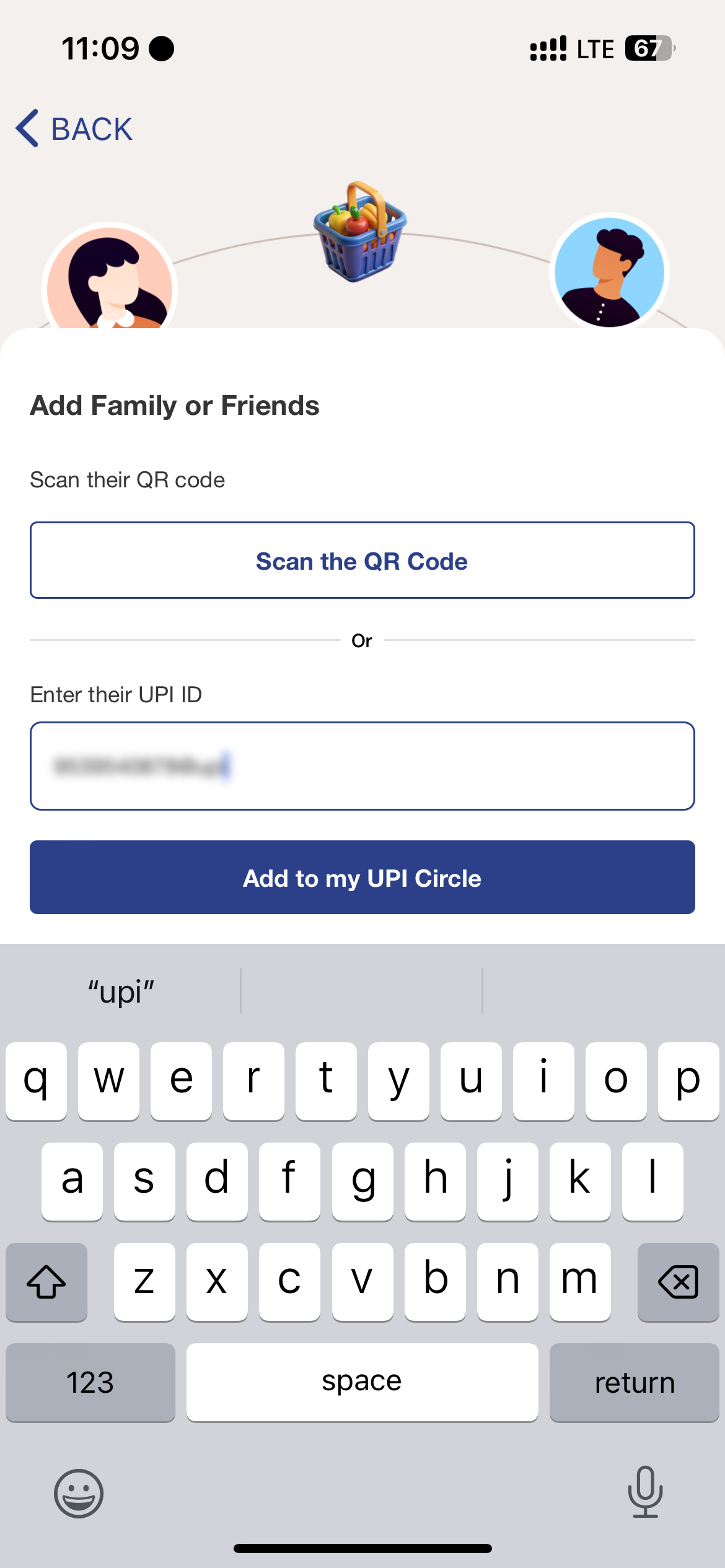

Step 3: Add Secondary Users

Add trusted individuals by selecting contacts from your phonebook or by entering their UPI IDs directly. The system will send them notifications to join your circle. They must, however, be on an app that supports UPI Circle, such as BHIM UPI.

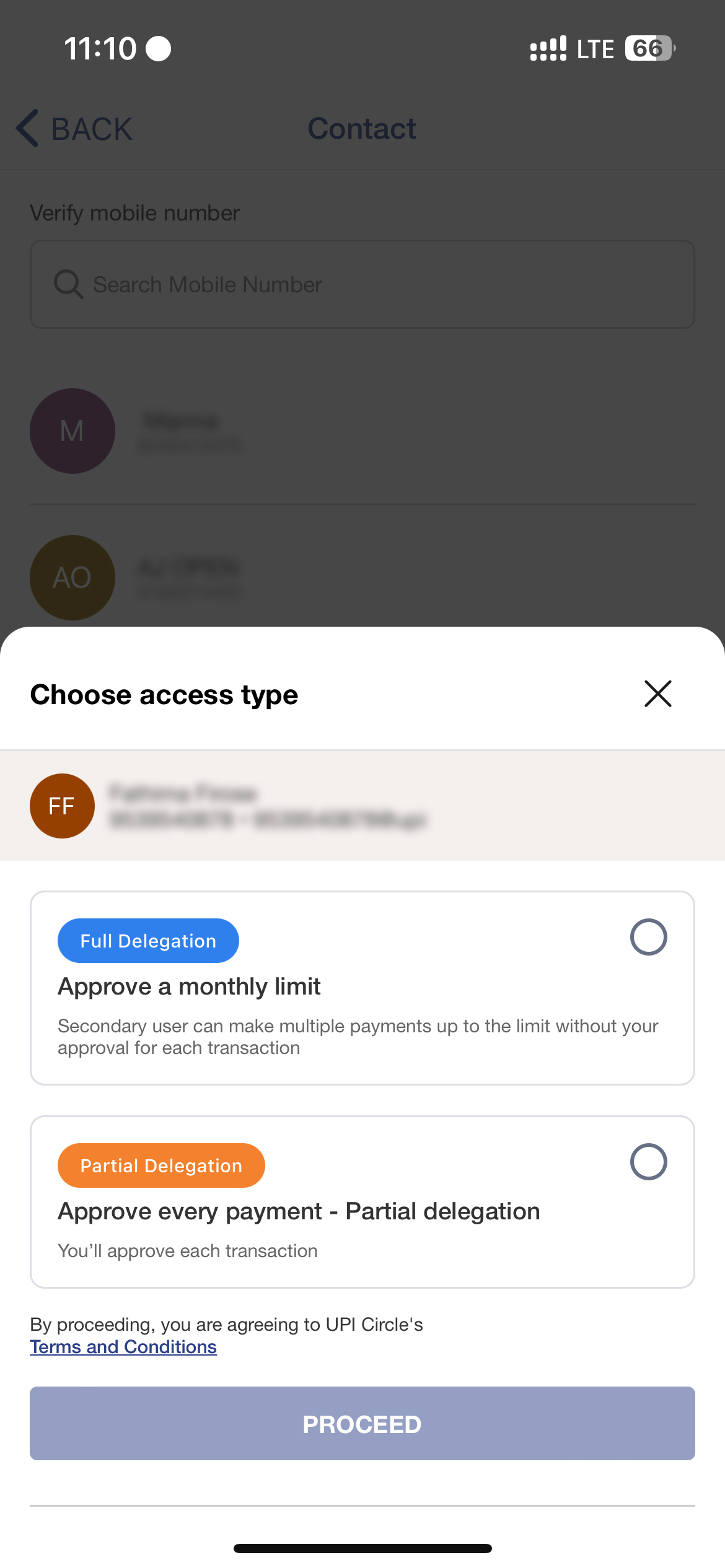

Step 4: Select Access Type

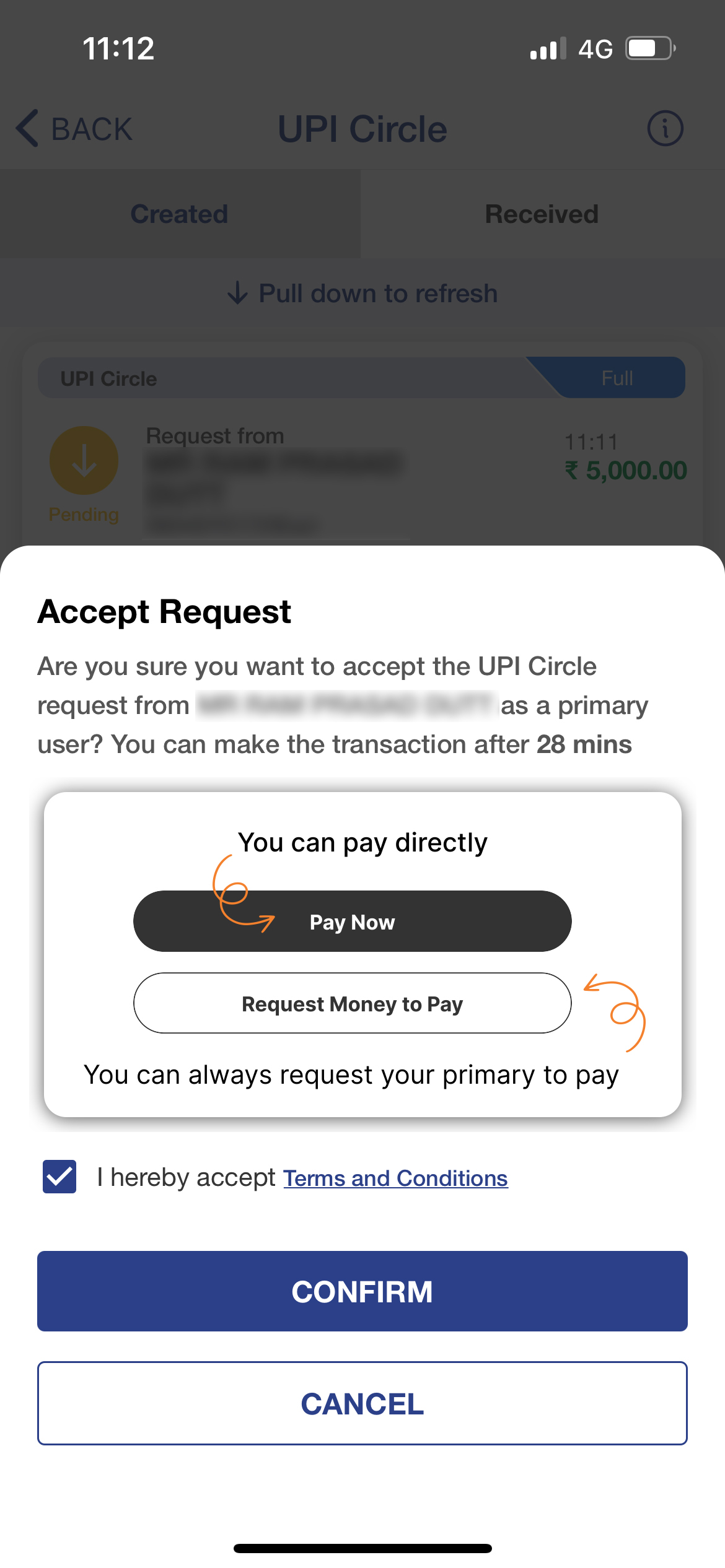

Select Full Delegation if you want to give your secondary user a monthly limit without having to manually approve each transaction.

Select Partial Delegation if you want to review and approve each transaction.

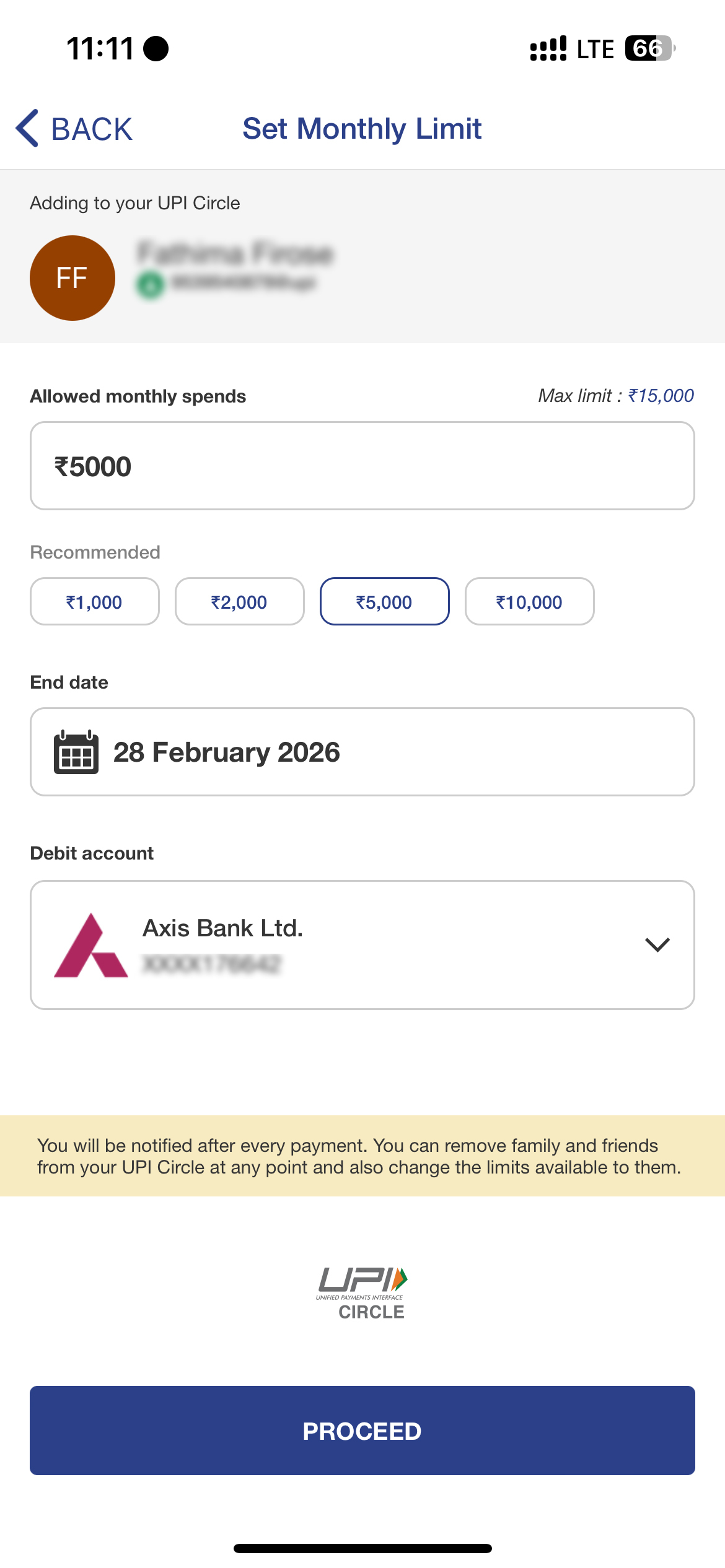

Step 4: Set Transaction Limits

Define the monthly spending limits for each secondary user.

Step 6: Confirm and Activate

Review all settings and confirm to activate your UPI Circle. Once activated, your circle members can begin making authorized transactions after 30 minutes of cooldown for added security.

Key Features of UPI Circle

Streamlined Group Creation

Create distinct circles for different groups in your life – one for family, another for roommates, and separate ones for different friend groups or projects. Each circle maintains its own expense history and settlement tracking.

Transparent Expense Tracking

Every group member can view shared expenses in real-time. When someone adds a new expense, all members receive notifications, maintaining complete transparency without requiring constant messaging.

Flexible Splitting Options

UPI Circle recognizes that not all expenses should be divided equally. Users can choose from:

- Equal splits across all members

- Custom amount allocations

- Options to exclude specific members from certain expenses

Simplified Debt Settlement

The intelligent settlement feature automatically calculates the most efficient way for members to settle debts, reducing the number of transactions needed and eliminating confusion about who owes what to whom.

Benefits of UPI Circle for Managing Group Payments

UPI Circle offers numerous advantages that make it an essential tool for modern financial management:

For Families

- Parents can allow children to make necessary payments without giving them direct bank access

- Elderly family members can authorize trusted relatives to handle utility and medical payments

- Transparency in household expense management

For Businesses

- Business owners can delegate payment authority to staff without sharing bank credentials

- Department-wise budget allocation and tracking

- Simplified expense management for small teams

For Friend Groups

- Easy management of group trips and outings

- Simplified bill splitting for shared accommodations

- Transparent tracking of group expenses

Frequently Asked Questions (FAQs)

Q: Can secondary users see my bank account details?

A: No, secondary users can only initiate transactions without seeing your bank account information or balance.

Q: How quickly are UPI Circle payments processed?

A: Instant processing for full delegation; approval-based transactions depend on the primary user’s response time.

Q: Can I temporarily disable a secondary user’s access?

A: Yes, you can pause access for any secondary user without removing them from your circle.

Q: What happens if a transaction exceeds the set limit?

A: The transaction will be declined automatically, and both primary and secondary users will receive notifications.

Q: Is there a fee for using UPI Circle?

A: UPI Circle is currently offered free of charge, with standard UPI transaction policies applying.

Q: Can I create different circles for different purposes?

A: Yes, you can create multiple circles with different members and transaction limits for various purposes.

Endnote

What makes UPI Circle particularly remarkable is how it balances security with accessibility. By maintaining control while enabling delegation, it preserves the integrity of your financial information while extending functionality to those you trust most. This thoughtful design reflects NPCI’s deep understanding of both technological capabilities and human needs.

As digital payments continue to reshape India’s financial ecosystem, features like UPI Circle demonstrate that innovation isn’t just about technology – it’s about enhancing human connections and simplifying everyday interactions. By reducing the friction associated with shared expenses, UPI Circle allows us to focus on what truly matters: the experiences we share and the relationships we build.

Discover how this powerful tool can transform your approach to group finances. In a world where digital solutions increasingly define our financial interactions, UPI Circle stands as a testament to thoughtful innovation that puts people first.

The future of group payments is here – and it’s more connected, more transparent, and more accessible than ever before.

Interested in our APIs? Let’s talk!

Tell us your automation goals, and we’ll set you up with a free, personalized demo from our API expert.

Click Here

0 Comments